COVID19 - Care Leave

COVID19 - Care Leave goes into effect on April 1, 2020.

This earning will become available for 4/1/2020 and applies to leave take between April 1, 2020 and December 31, 2020.

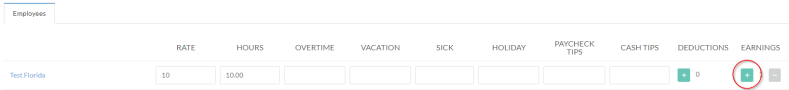

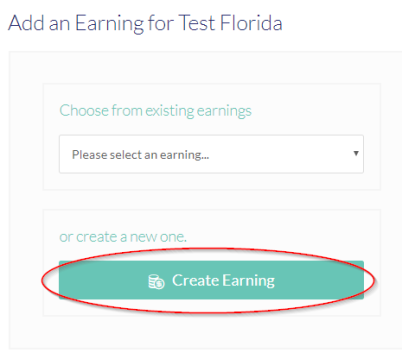

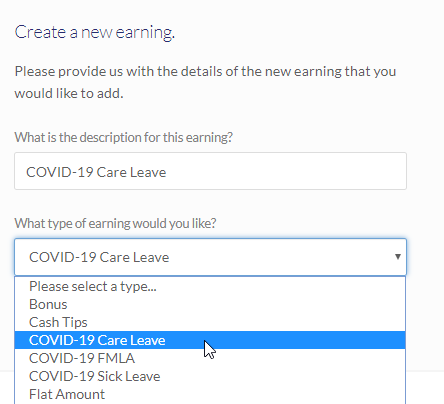

COVID19 - Care Leave can be added within the application during the payroll process:

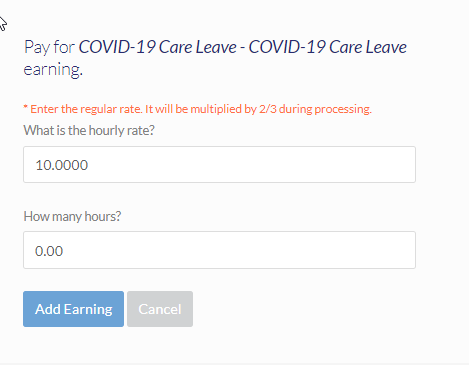

Click the teal + sign beneath the earnings column > Create Earning > Enter a description and choose the appropriate earning model from the drop down > Create Earning > The model automatically brings in the employees rate on the grid - Do not change the rate as the application will automatically apply the 2/3rds Rule, add the hours > Add Earning

Once the earning has been added, the application will account for the reduction of ER Social Security liability associated with this specific earning.

**Please note this article will be updated as additional information becomes available.**

Notice Requirements: Employers must post a notice for employees to see as provided by the federal government. We will send you a copy of the proper notice as soon as available.

Emergency Paid Sick Leave

This pertains to ALL employers with fewer than 500 employees and ALL employees no matter how long they have been employed (some health care providers and emergency responders may be excluded). Full time employees are entitled to 80 hours of paid sick leave and part time employees are entitled to sick leave equal to the average number of hours in a two week period.

When should this earning be used? Employees may be eligible for COVID19- Care Leave if they meet the below criteria:

-

When caring for an individual who is sick or quarantined; 2/3 regular rate of pay capped at $200/day.

-

When caring for a child whose school or place of care is closed due to COVID-19 (2/3 pay); 2/3 regular rate of pay capped at $200/day.

Payroll Tax Credit

-

Applies to both the emergency FMLA expansion and the emergency sick leave.

-

Dollar for dollar credit for sick leave and paid FMLA wages against the employer portion of Social Security taxes.

-

Refund is possible for amounts that exceed what is available as a credit.

Resources:

Family First Coronavirus Response Act

CertiPay News: COVID-19 Client Update 3.23.2020